Expert Tips on Navigating Your Debt Management Plan Singapore Options

Expert Tips on Navigating Your Debt Management Plan Singapore Options

Blog Article

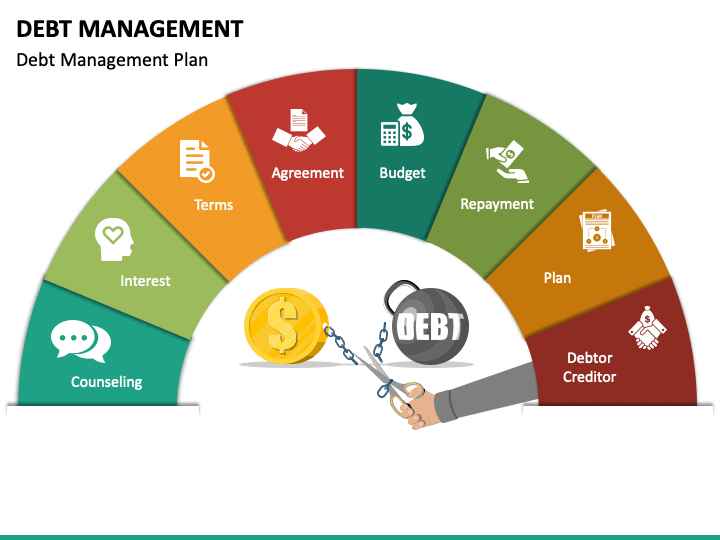

Just How an Expertly Crafted Financial Obligation Management Strategy Can Change Your Financial Scenario

Among the difficulties that monetary commitments present, there exists a beacon of hope in the type of expertly crafted financial debt administration plans. Via a combination of calculated arrangement, monetary knowledge, and structured preparation, the transformative power of a well-executed debt management plan can be a stimulant for reshaping your monetary future.

Benefits of a Professional Debt Monitoring Plan

Engaging a specialist financial debt management plan can dramatically streamline the process of dealing with monetary commitments with knowledge and effectiveness. This tailored strategy enhances the possibility of efficiently taking care of and reducing financial debt.

In addition, professional financial obligation monitoring plans commonly come with the advantage of lower interest rates negotiated by the experts. With their market understanding and recognized partnerships with financial institutions, specialists can commonly protect minimized rates, causing general cost savings for the individual. Furthermore, these strategies usually include an organized settlement routine that is much more convenient for the customer, making certain prompt repayments and progress towards financial debt decrease goals.

Custom-made Financial Method

The development of a customized monetary technique is important for effectively decreasing and managing financial obligation. A customized economic strategy takes into consideration a person's unique economic situations, objectives, and difficulties. debt management plan singapore. By assessing aspects such as income, expenses, properties, and financial obligation commitments, an individualized plan can be established to address specific needs and concerns

One secret benefit of a personalized economic strategy is its ability to provide a clear roadmap for achieving financial debt monitoring goals. By detailing workable steps and timelines, people can remain focused and inspired in the direction of decreasing their financial debt problem. Furthermore, a customized strategy can also assist people make educated decisions regarding budgeting, conserving, and spending, thus boosting overall financial health and wellness.

A tailored strategy can be adaptable adequate to suit these adjustments while still functioning in the direction of financial debt decrease and financial stability. Eventually, a tailored monetary technique offers as an effective device in transforming one's financial situation and attaining long-lasting success.

Lower Rate Of Interest Prices and Charges

After establishing a personalized financial strategy to resolve private financial obligation management requires, the following vital step involves discovering chances to lower rates of interest and charges. Reducing interest prices and charges can considerably influence a person's ability to repay financial obligation efficiently. One means to accomplish this is by combining high-interest debts right into a single, reduced interest price loan. Financial obligation debt consolidation can simplify month-to-month repayments and reduce the general interest paid, aiding individuals save cash in the future.

Discussing with financial institutions is an additional effective method to reduced passion rates and charges. Several creditors want to bargain reduced rates of interest or forgo particular fees if approached skillfully. Looking for equilibrium transfer uses with reduced initial prices can additionally be a savvy relocate to minimize passion prices momentarily.

Moreover, working with a respectable credit rating counseling agency can provide access to financial debt management strategies that bargain reduced rate of interest and charges with creditors in support of the person. These strategies commonly include structured payment routines that make it easier for individuals to manage their financial obligation efficiently while saving money on rate of interest payments. By proactively looking for methods to lower passion prices and charges, people can take substantial strides towards improving their economic wellness.

Consolidation and Simplification

To streamline debt payment and improve economic organization, checking out combination and simplification techniques is essential for individuals seeking effective financial obligation management services. Debt consolidation entails combining multiple financial obligations into a solitary account, usually with a reduced passion price, making it easier to manage and potentially decreasing general prices.

Simplification, on the various other hand, requires arranging funds in a means that is very easy to recognize and take care of. This might entail developing a spending plan, monitoring expenditures, and establishing monetary goals to prioritize financial debt settlement. Streamlining economic issues can minimize anxiety and enhance decision-making relating to finance.

Improved Credit History and Financial Health

Enhancing one's credit history score and overall financial wellness is an essential element of effective debt monitoring and lasting monetary stability. A professionally crafted debt monitoring strategy can play a vital function in improving these key locations. By combining debts, negotiating reduced rate of interest rates, find more and producing a structured repayment timetable, individuals can function towards decreasing their debt worry, which consequently positively influences their credit rating. As debts are settled systematically and in a timely manner, credit score usage ratios enhance, and a history of timely settlements is established, both of which are essential elements in determining one's debt score.

Moreover, as people follow the guidelines established forth in a financial obligation monitoring plan, they create better monetary behaviors and technique. This newfound monetary duty not just aids in removing current financial debts but additionally establishes a strong foundation for future economic Find Out More undertakings. By following the tailored techniques detailed in the plan, individuals can gradually reconstruct their creditworthiness and overall financial health, paving the way for a much more protected and thriving financial future.

Final Thought

In final thought, a properly crafted financial debt monitoring strategy can substantially enhance one's financial situation by giving a customized approach, reduced rates of interest and fees, consolidation of financial debts, and inevitably causing an enhanced credit report and total economic health and wellness. It is a structured strategy to taking care of financial obligations that can help people regain control of their finances and job towards an extra steady financial future.

Via a combination of critical settlement, monetary experience, and structured planning, the transformative power of a well-executed financial obligation monitoring plan can be a driver for improving your financial future.

To improve debt repayment and enhance economic organization, exploring debt consolidation and simplification methods is necessary for people seeking efficient financial debt management services.Enhancing one's credit rating rating and overall monetary health and wellness is a crucial aspect of effective financial debt management and long-lasting monetary security. By combining financial debts, negotiating lower interest rates, and producing a structured discover this payment routine, people can function in the direction of minimizing their financial debt worry, which in turn favorably influences their credit rating score.Additionally, as individuals adhere to the guidelines set forth in a debt management plan, they develop better financial habits and discipline.

Report this page